Fintechzoom Bitcoin Wallet: Your Secure Gateway To Crypto In 2025

In the rapidly evolving world of digital finance, the security of your cryptocurrency holdings is paramount. As we navigate through 2025, the need for a robust and reliable solution to manage your digital assets, particularly Bitcoin, has never been more critical. This comprehensive guide delves into the essence of cryptocurrency wallets, with a particular focus on the Fintechzoom Bitcoin Wallet, a platform gaining significant traction for its blend of security and user-friendliness.

Whether you're a seasoned crypto enthusiast or just embarking on your journey into the decentralized future, understanding how to securely store Bitcoin is fundamental. The landscape of digital assets is dynamic, filled with opportunities but also potential pitfalls like scams and hacking attempts. This guide aims to demystify the intricacies of Bitcoin wallets, offering clear explanations, practical setup steps, and best practices to ensure the safety and accessibility of your valuable digital currency. We will explore how Fintechzoom positions itself as an ideal choice, especially for beginners, balancing accessibility with robust protection, making it a trusted platform in the fintech space.

Table of Contents

- Understanding the Essence of a Cryptocurrency Wallet

- Exploring Different Types of Bitcoin Wallets

- Fintechzoom Bitcoin Wallet: A Deep Dive into its Features

- Setting Up Your Fintechzoom Bitcoin Wallet: A Step-by-Step Guide

- Best Practices for Bitcoin Wallet Security in 2025

- Navigating the Crypto Landscape with Fintechzoom Pro

- Choosing the Right Bitcoin Wallet: Beyond Fintechzoom

- The Future of Crypto Security and Fintechzoom's Role

Understanding the Essence of a Cryptocurrency Wallet

Before diving into the specifics of the Fintechzoom Bitcoin Wallet, it's crucial to grasp the foundational concept of a cryptocurrency wallet itself. Many newcomers to the crypto space mistakenly believe that a wallet physically "stores" their digital coins, much like a traditional leather wallet holds cash. This common misconception can lead to misunderstandings about how digital assets are secured and managed. In reality, the mechanism is far more sophisticated and entirely digital.

What Exactly is a Crypto Wallet?

Simply put, a cryptocurrency wallet is a digital tool—either a software program or a physical device—that allows users to securely store and manage their cryptocurrency holdings. Unlike traditional wallets that store physical cash or cards, crypto wallets store digital assets such as Bitcoin, Ethereum, and other cryptocurrencies by managing the cryptographic keys associated with them. These wallets serve as secure repositories for users’ private keys, which are the essential elements for managing and accessing their cryptocurrencies. When you "own" Bitcoin, what you truly possess are the private keys that grant you the authority to spend or transfer those Bitcoins on the blockchain. The Bitcoin itself resides on the decentralized ledger, the blockchain, not within your wallet.

A cryptocurrency wallet acts as your interface to the blockchain. It generates and stores the unique public and private key pairs that are fundamental to cryptocurrency transactions. The public key, similar to a bank account number, is what you share with others to receive funds. The private key, on the other hand, is like your PIN or password; it's a secret string of characters that proves your ownership of the funds associated with your public key and authorizes transactions. Losing this private key means losing access to your funds, which underscores the immense importance of secure wallet management.

Why is a Crypto Wallet Indispensable?

The indispensability of a crypto wallet stems directly from the decentralized nature of cryptocurrencies. Without a central authority like a bank to manage your funds, you become your own bank. This freedom comes with the significant responsibility of securing your own assets. These wallets provide secure access to private keys—the essential credentials needed to manage and access your crypto holdings. Without a wallet, you cannot interact with the blockchain to send or receive Bitcoin, nor can you verify your ownership of any digital assets. It’s the gateway to your digital wealth, the control panel for your financial autonomy in the crypto world.

- Qr Ip Cam Telegram

- Alana Cho Leak Porn

- John Hurt

- Jayshree Gaikwad All Webseries List

- Xxxxxx Is Equal To 2

Furthermore, in an era where digital security threats are constantly evolving, a reliable crypto wallet is your primary defense. Keeping your Bitcoin safe in 2025 isn’t just about stashing it away—it’s about choosing the right wallet to protect it from hackers, scams, and even your own forgetfulness. A well-chosen wallet employs advanced encryption and security protocols to safeguard your private keys, making unauthorized access exceedingly difficult. It also provides a user-friendly interface to track your balances, view transaction history, and execute transfers, transforming complex blockchain interactions into simple, manageable actions for the everyday user.

Exploring Different Types of Bitcoin Wallets

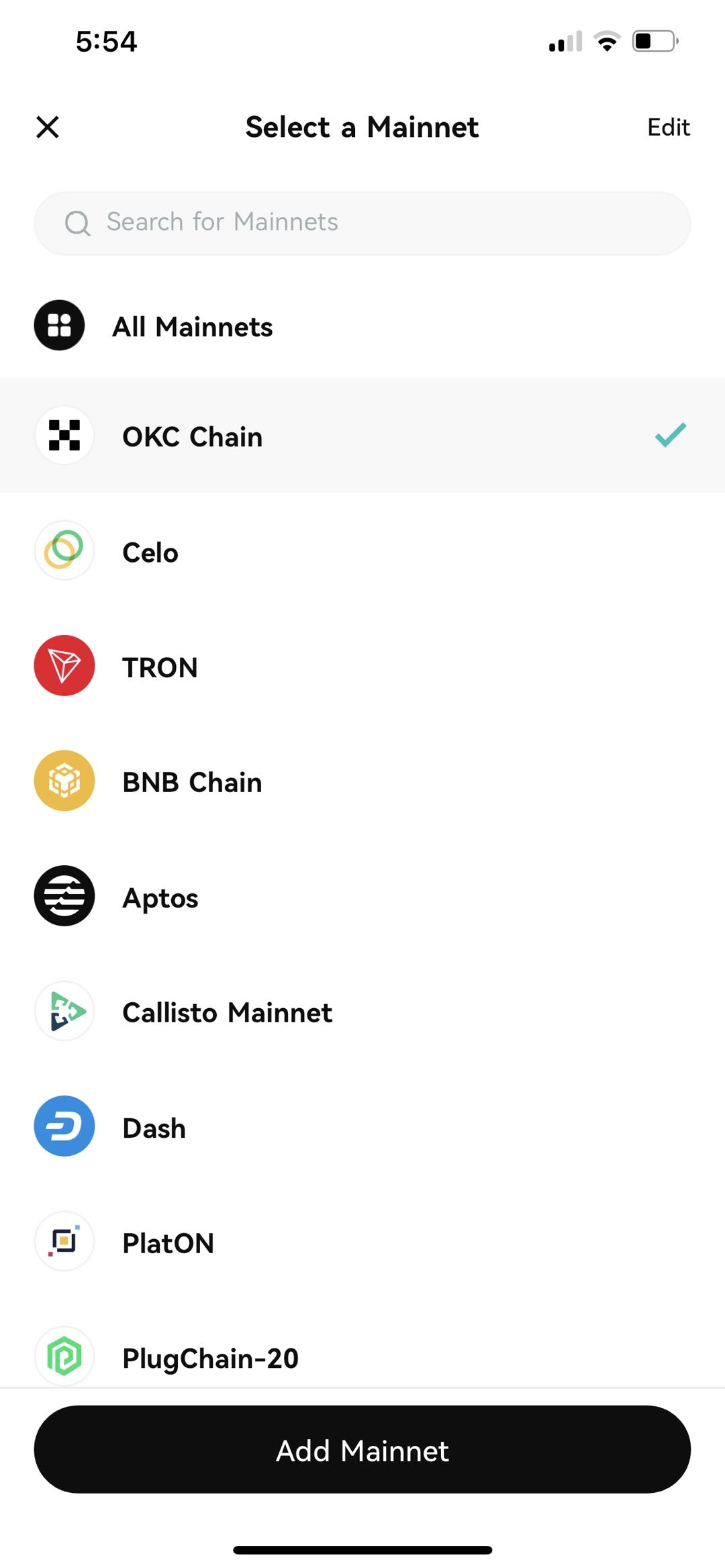

The world of cryptocurrency wallets is diverse, offering various forms designed to cater to different needs, security preferences, and levels of technical expertise. Understanding these distinctions is vital for making an informed decision about where to secure your digital assets. Crypto wallets come in various forms, including hardware, software (which encompasses desktop and mobile), and custodial wallets. Each type presents a unique balance of security, convenience, and accessibility.

Hardware Wallets: The Gold Standard of Security

Hardware wallets are physical devices, often resembling a USB stick, specifically designed to store your private keys offline. They are widely considered the most secure type of crypto wallet because they isolate your private keys from internet-connected devices, thereby minimizing the risk of online hacks and malware. When you want to make a transaction, you connect the hardware wallet to your computer or mobile device, sign the transaction on the device itself, and then broadcast it to the network. Your private keys never leave the hardware device, even if the connected computer is compromised. This "cold storage" method is the ultimate safeguard against cyber threats.

Popular examples include Ledger and Trezor. While they offer unparalleled security, their main drawback is their cost and slightly less convenience compared to software wallets. However, for significant amounts of Bitcoin or other cryptocurrencies, the investment in a hardware wallet is almost universally recommended by security experts. They are the go-to choice for those prioritizing maximum protection for their long-term holdings, embodying the "hot or cold" storage debate by representing the "cold" side of the spectrum.

Software Wallets: Convenience at Your Fingertips (Desktop & Mobile)

Software wallets, also known as "hot wallets" because they are connected to the internet, are applications that run on your computer or smartphone. They offer a high degree of convenience, allowing for quick and easy transactions. These wallets, available in various forms such as desktop and mobile, serve as secure repositories for users’ private keys, the essential elements for managing and accessing their cryptocurrencies. However, because they are online, they are inherently more susceptible to security risks like malware, phishing attacks, and viruses if your device is compromised.

- Desktop Wallets: These are software programs installed directly onto your computer. They offer a good balance of security and control, as your private keys are stored on your local machine. However, the security of your funds depends heavily on the security of your computer. If your computer is hacked or infected with malware, your funds could be at risk.

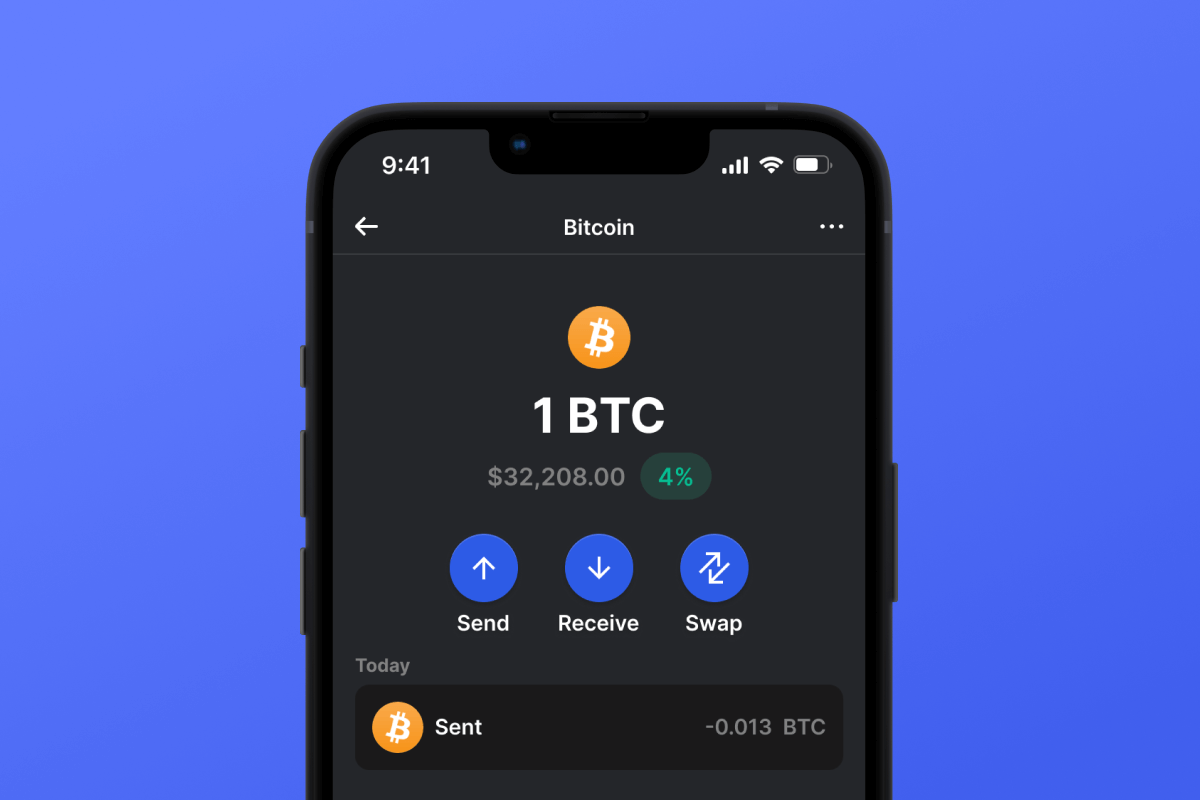

- Mobile Wallets: Designed for smartphones, mobile wallets provide the ultimate convenience for everyday transactions. They allow you to send and receive Bitcoin on the go, often with QR code scanning capabilities. While convenient, mobile devices are also prone to loss, theft, and app-specific vulnerabilities. It's crucial to use strong passwords, biometric authentication, and keep your device's operating system updated.

- Web Wallets: These are online wallets accessed through a web browser. They are the most convenient but also the least secure, as your private keys are often stored on a third-party server. While some reputable web wallets exist, they require a high degree of trust in the service provider. For this reason, they are generally not recommended for storing large amounts of cryptocurrency.

The choice between hardware and software wallets often comes down to a trade-off between security and accessibility. For active traders or those holding smaller amounts, software wallets offer the necessary flexibility. For long-term hodlers with substantial investments, hardware wallets provide peace of mind.

Fintechzoom Bitcoin Wallet: A Deep Dive into its Features

In the crowded market of cryptocurrency wallets, the Fintechzoom Bitcoin Wallet has emerged as a noteworthy contender, particularly praised for its security and ease of use. It strikes a crucial balance, making it ideal for beginners while simultaneously offering robust protection that appeals to more experienced users. This platform understands that the barrier to entry for many new crypto participants is often the perceived complexity and security concerns surrounding digital assets.

Fintechzoom Bitcoin Wallet offers easy setup and crypto security, addressing two of the most significant pain points for new users. Its design philosophy centers around simplifying the user experience without compromising on the underlying security infrastructure. This means that even if you're not deeply familiar with cryptographic principles, you can confidently manage your Bitcoin and other digital assets. The interface is intuitive, guiding users through the process of creating a wallet, sending, and receiving funds with clear, concise instructions.

The platform’s commitment to robust protection is evident in its implementation of industry-standard security measures. While specific details of their proprietary security protocols are often kept confidential for obvious reasons, reputable wallets like Fintechzoom typically employ multi-factor authentication (MFA), secure encryption for private keys, and regular security audits. For a software-based solution, this level of diligence is critical. They aim to provide a secure environment where users can manage their holdings without constant fear of external threats.

Furthermore, Fintechzoom's crypto wallet is often highlighted in various reviews and comparisons, positioning it among the best crypto wallets for 2025. When evaluating wallets for price, features, and security, Fintechzoom consistently appears as a strong option for those seeking a reliable and user-friendly experience. It understands that the "best" wallet isn't just about the most advanced features, but about the right fit for the user's needs, balancing cutting-edge technology with practical usability. This focus on balancing accessibility and robust protection makes Fintechzoom's crypto wallet a compelling choice for anyone looking to enter or deepen their involvement in the digital asset space.

Setting Up Your Fintechzoom Bitcoin Wallet: A Step-by-Step Guide

One of the core strengths of the Fintechzoom Bitcoin Wallet is its straightforward setup process, designed to be accessible even for those with minimal technical expertise. Getting started with your digital asset management on Fintechzoom is typically a smooth journey, prioritizing user experience from the very first step. While exact steps may vary slightly with updates, the general process follows a logical and intuitive path.

Here’s a generalized guide on how to set up your Fintechzoom Bitcoin Wallet:

- Visit the Official Fintechzoom Website or Download the App: The first and most crucial step is to ensure you are accessing the legitimate Fintechzoom platform. Whether you prefer a desktop experience or mobile convenience, navigate to their official website or download their application from a trusted source (e.g., Google Play Store, Apple App Store). Be extremely wary of phishing sites or unofficial apps.

- Create an Account: You'll likely be prompted to create an account. This typically involves providing an email address, creating a strong, unique password, and agreeing to their terms of service. Choose a password that is complex and not used for any other online service.

- Complete Identity Verification (KYC): As a regulated financial platform, Fintechzoom, like many reputable crypto services, will likely require Know Your Customer (KYC) verification. This involves submitting identification documents (e.g., passport, driver's license) and sometimes a selfie for facial recognition. This step is essential for security, compliance, and helps prevent fraud and illicit activities. While it adds a step, it enhances the trustworthiness of the platform.

- Enable Two-Factor Authentication (2FA): This is a non-negotiable security measure. Fintechzoom Bitcoin Wallet will guide you to enable 2FA, usually through an authenticator app (like Google Authenticator or Authy) or SMS. This adds an extra layer of security, requiring a code from your device in addition to your password to log in or authorize transactions.

- Generate Your Wallet Address: Once your account is set up and verified, you can generate your Bitcoin wallet address within the Fintechzoom interface. This is your public address, which you can share with others to receive Bitcoin.

- Understand and Secure Your Seed Phrase/Recovery Phrase: While Fintechzoom, as a software wallet, manages your private keys on its platform, it's paramount to understand how recovery works. For non-custodial wallets, a seed phrase (a series of 12 or 24 words) is generated, which is your ultimate backup. If Fintechzoom provides you with a seed phrase for a non-custodial option, write it down physically and store it in multiple secure, offline locations. Never store it digitally or share it with anyone. This phrase is the master key to your funds.

- Fund Your Wallet: You can now deposit Bitcoin into your Fintechzoom wallet. This typically involves sending Bitcoin from another wallet or purchasing it directly through Fintechzoom if they offer buying services. Double-check the recipient address before confirming any transaction.

The ease of setup with Fintechzoom makes it an attractive option for those who might be intimidated by the technicalities of other wallet types. However, ease should never overshadow the importance of personal security practices, which we will delve into next.

Best Practices for Bitcoin Wallet Security in 2025

Securing your Bitcoin in 2025 goes far beyond merely choosing a reliable wallet like the Fintechzoom Bitcoin Wallet. It involves adopting a diligent approach to digital hygiene and understanding the nuances of cryptocurrency security. As the digital asset landscape matures, so do the tactics of those who seek to exploit vulnerabilities. Keeping your Bitcoin safe isn’t just about stashing it away—it’s about choosing the right wallet to protect it from hackers, scams, and even your own forgetfulness!

Here are essential best practices for safeguarding your Bitcoin and other digital assets:

- Enable Two-Factor Authentication (2FA) Everywhere: This is arguably the most critical step. Always enable 2FA on your Fintechzoom account, email, and any other crypto-related services. Use authenticator apps (like Google Authenticator, Authy) over SMS-based 2FA, as SMS can be vulnerable to SIM-swap attacks.

- Use Strong, Unique Passwords: Create complex, unique passwords for every crypto-related account. Never reuse passwords. A password manager can help you manage these securely.

- Beware of Phishing Scams: Always double-check the URL of any website you visit, especially when logging into your Fintechzoom Bitcoin Wallet or other crypto platforms. Phishing sites mimic legitimate ones to steal your credentials. Never click on suspicious links in emails or messages.

- Secure Your Seed Phrase/Recovery Phrase (if applicable): If your wallet provides a seed phrase, write it down on paper and store it in multiple secure, offline locations (e.g., a fireproof safe, a safety deposit box). Never store it on any digital device, in the cloud, or share it with anyone. This phrase is the ultimate key to your funds.

- Keep Software Updated: Ensure your operating system, antivirus software, and the Fintechzoom app (or any other wallet software) are always up to date. Updates often include critical security patches.

- Be Skeptical of Unsolicited Offers: If an offer seems too good to be true (e.g., guaranteed high returns, free crypto giveaways), it almost certainly is a scam.

- Use a VPN on Public Wi-Fi: Public Wi-Fi networks are often insecure. If you must access your wallet on public Wi-Fi, use a Virtual Private Network (VPN) to encrypt your connection.

- Diversify Your Wallet Strategy: For significant holdings, consider diversifying your storage methods. A combination of a secure software wallet like Fintechzoom for smaller, active amounts and a hardware wallet for larger, long-term holdings is a common and highly recommended strategy.

- Regularly Back Up Your Wallet (if applicable): For certain types of software wallets, regular backups of your wallet file are crucial. Understand how your specific wallet handles backups.

- Educate Yourself Continuously: The crypto space evolves rapidly. Stay informed about new security threats, best practices, and technological advancements. Resources like bitcoin.org and reputable crypto news outlets are invaluable.

By diligently following these best practices, you significantly enhance the security posture of your Bitcoin holdings, transforming the potential risks into manageable challenges. A secure wallet, combined with smart user habits, is your strongest shield in the digital financial frontier.

Navigating the Crypto Landscape with Fintechzoom Pro

Beyond offering a secure and user-friendly Bitcoin wallet, Fintechzoom extends its value proposition through Fintechzoom Pro, positioning itself as your trusted guide to unraveling the world of digital finance. The cryptocurrency revolution is driven by its transformative power, but the benefits, market trends, and investment prospects are constantly changing. Keeping up with this pace requires access to reliable resources and expert insights, which is precisely what Fintechzoom Pro aims to deliver.

Fintechzoom Pro is designed for individuals who want to stay ahead in the dynamic crypto market. It provides expert insights on crypto trends, Bitcoin market shifts, and emerging opportunities, empowering users to make informed decisions and manage risks smartly. This platform goes beyond basic wallet functionality, offering a holistic approach to engaging with the digital economy. Whether you're interested in identifying the next big altcoin, understanding the macroeconomic factors influencing Bitcoin's price, or simply seeking clarity on complex blockchain concepts, Fintechzoom Pro strives to be your go-to resource.

The core philosophy of Fintechzoom Pro is to equip users with the knowledge and tools needed to explore the future of finance with confidence. This includes:

- Market Analysis: Access to in-depth analyses of market movements, price predictions, and factors driving crypto valuations.

- Trend Spotting: Early insights into emerging technologies, new blockchain projects, and shifts in investor sentiment.

- Educational Content: Comprehensive guides and articles that demystify complex topics, from decentralized finance (DeFi) to non-fungible tokens (NFTs) and beyond.

- Risk Management Strategies: Guidance on how to assess and mitigate risks inherent in crypto investments, promoting responsible participation.

By integrating a secure wallet solution with a rich knowledge base and analytical tools, Fintechzoom creates an ecosystem where users can not only store their assets safely but also grow their understanding and participate more effectively in the digital economy. Let Fintechzoom Pro lead the way on your crypto journey, transforming uncertainty into informed decision-making and helping you navigate the exciting, yet often volatile, world of digital assets with greater assurance.

Choosing the Right Bitcoin Wallet: Beyond Fintechzoom

While the Fintechzoom Bitcoin Wallet offers an excellent balance of security and ease of use, particularly for beginners, the "best" wallet is ultimately subjective and depends on individual needs, risk tolerance, and the amount of Bitcoin you hold. The market for crypto wallets is vast and competitive, with many reputable options available. Are you looking for the best crypto & Bitcoin wallets in 2025? It's a question many ask, and thankfully, there are numerous resources comparing and ranking the best options based on various criteria like price, features, security, and more.

When considering your options beyond Fintechzoom, it's essential to revisit the hot vs. cold storage debate and weigh the pros and cons of software vs. hardware solutions. Your guide to the best Bitcoin wallet in Canada, or anywhere else, will often highlight these fundamental choices.

Factors to consider when choosing a wallet:

- Security Features: Look for multi-factor authentication, robust encryption, and a strong track record of security. For significant holdings, hardware wallets like Ledger and Trezor remain top choices due to their offline key storage.

- Ease of Use: Especially for beginners, an intuitive interface and straightforward setup process are crucial. Fintechzoom excels here, but other software wallets like Exodus or Electrum (for desktop) also offer user-friendly experiences.

- Supported Cryptocurrencies: If you plan to hold more than just Bitcoin, ensure the wallet supports a wide range of cryptocurrencies.

- Control Over Private Keys: Do you want full control over your private keys (non-custodial wallet) or are you comfortable trusting a third party (custodial wallet)? Fintechzoom, as a software wallet, may lean towards a custodial or semi-custodial model, which offers convenience but means you don't hold the keys yourself. For absolute control, a hardware wallet or a self-hosted desktop wallet is necessary.

- Community Reputation and Support: Research user reviews, community forums, and the responsiveness of customer support. A strong reputation often indicates reliability and trustworthiness.

- Cost: Hardware wallets have an upfront cost, while most software wallets are free. Consider the value you place on enhanced security versus convenience.

- Anonymity/Privacy Features: Some wallets offer enhanced privacy features, which might be a consideration for users who prioritize transactional anonymity.

Resources like Cryptomaniaks often compare and rank the best crypto wallets, providing valuable insights into their features, security protocols, and suitability for different user profiles. They might even touch upon advanced topics like understanding crypto taxation and streamlining reporting with reliable crypto tax software, which becomes relevant as your crypto portfolio grows. The key is to do your due diligence and select a wallet that aligns perfectly with your specific requirements and comfort level with managing digital assets.

The Future of Crypto Security and Fintechzoom's Role

The landscape of cryptocurrency security is in a perpetual state of evolution, driven by technological advancements and the ever-present cat-and-mouse game with malicious actors. As we look towards the future, perhaps even beyond 2025, the emphasis on robust, user-friendly security solutions will only intensify. The core principles of safeguarding private keys will remain, but the methods and interfaces for doing so are likely to become even more sophisticated and seamlessly integrated into our digital lives.

Emerging trends in crypto security include:

- Enhanced Biometric Authentication: Beyond fingerprint and facial recognition, more advanced biometric methods could become standard for wallet access, offering a higher level of personal security.

- Multi-Party Computation (MPC) Wallets: These wallets distribute the private key across multiple parties, meaning no single entity holds the entire key. This significantly reduces the risk of a single point of failure and makes hacks much harder.

- Social Recovery Wallets: A concept where trusted friends or family members can help you recover access to your wallet if you lose your seed phrase or private key, without them ever having direct access to your funds.

- Improved User Education and Tools: As the industry matures, there will be a greater focus on providing accessible educational resources and tools that empower users to manage their own security effectively.

- Regulatory Clarity: Clearer regulations around crypto exchanges and wallet providers will likely lead to higher industry standards for security and consumer protection.

In this evolving environment, platforms like Fintechzoom are poised to play a crucial role. By continually innovating and adapting their Fintechzoom Bitcoin Wallet and broader services, they can help bridge the gap between complex blockchain technology and everyday users. Their focus on easy setup and crypto security positions them well to attract the next wave of crypto adopters. As the cryptocurrency revolution continues to unfold, with its transformative power impacting global finance, platforms that prioritize both security and user experience will be at the forefront.

Fintechzoom's commitment to being a trusted platform in the fintech space, coupled with its insights from Fintechzoom Pro, suggests a future where users can not only securely store their assets but also confidently navigate the complexities of the crypto market. The most popular and trusted Bitcoin block explorers and crypto transaction search engines will continue to provide transparency, but it's the secure, intuitive wallets that will truly empower individuals to harness the potential of this new kind of money. The future of finance is digital, and secure, accessible wallets like Fintechzoom's will be indispensable tools for participating in it.

Conclusion

The journey into the world of Bitcoin and other cryptocurrencies begins with understanding and securing your digital assets. As we've explored, a cryptocurrency wallet is not just a storage solution; it's your essential interface to the decentralized financial system, providing secure access to your private keys and enabling you to manage your crypto holdings. Whether you opt for the robust security of a hardware wallet or the convenience of a software solution, the principles of vigilance and informed decision-making remain paramount.

The Fintechzoom Bitcoin Wallet stands out as a compelling option, particularly for those new to the crypto space, offering an admirable balance of ease of use and robust security. Its commitment to simplifying the setup process while upholding strong protection measures makes it a trusted platform in the ever-expanding fintech landscape. Coupled with the expert insights provided by Fintechzoom Pro, users are equipped not only to secure their assets but also to make informed decisions and confidently navigate the dynamic crypto market.

As you embark on or continue your crypto journey, remember that keeping your Bitcoin safe in 2025 isn’t just about choosing a wallet; it’s about adopting a holistic approach to security, staying informed, and leveraging reliable resources. We encourage you to explore the Fintechzoom Bitcoin Wallet and other trusted solutions, always prioritizing your digital asset security. What are your thoughts on securing Bitcoin in 202

- Wwxx Lyrics

- Ww Xxcom

- Cal Raleigh Wife

- How To Remotely Connect To Raspberry Pi

- Jayshree Gaikwad Web Series List

Bitcoin Wallet | BTC Wallet for iOS & Android | Gem Wallet

Bitcoin Wallet | BRC20 Wallet | BTC Wallet | Bitget Wallet

:max_bytes(150000):strip_icc()/bitcoinwallet-exodus-5a684efdc064710019ac4879-5bd386c0c9e77c0051d011ec.jpg)

Best free bitcoin wallet - rosegai